Frequently Asked Questions

- ATM, Online, Mobile & Telephone Banking FAQ’s

- Bill Payments, Pre-authorized Withdrawals and Direct Deposits

- Interac® e-Transfers

- Small Business Online Banking

- Lines of Credit (LOC)

- Account & Membership Related FAQ’s

- Transaction History

- Accounts

- Banking System FAQ’s

- Statements

ATM, Online, Mobile & Telephone Banking FAQ’s

Will I be able to make bill payments at the ATM? What are my options for bill payments?

Bill payments at the ATM will not be an option after the banking system upgrade. The good news is there are still many convenient ways to pay your bills. These include:

- Online and mobile banking

- Teletouch banking

- Call our Member Service Centre

- By setting up bill payments to be paid automatically from your Interior Savings credit card

- By visiting a branch

Will Teletouch Banking function differently?

Will there be any changes to the Budget and Spending Tools within Online Banking?

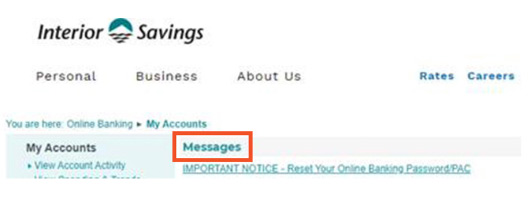

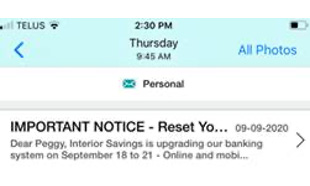

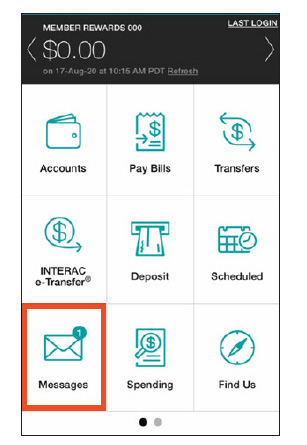

What does the message with the temporary password/PAC look like?

Why didn’t I receive a temporary password to log into online banking after the conversion?

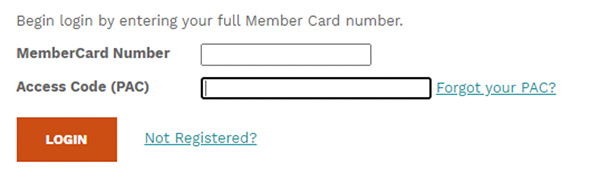

My online banking password/PAC is not working. How do I set up a new PAC?

How do I reset my password after the conversion?

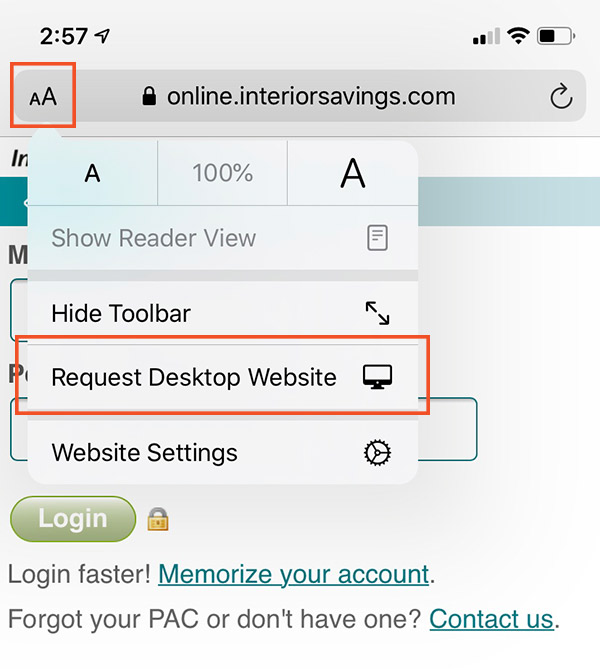

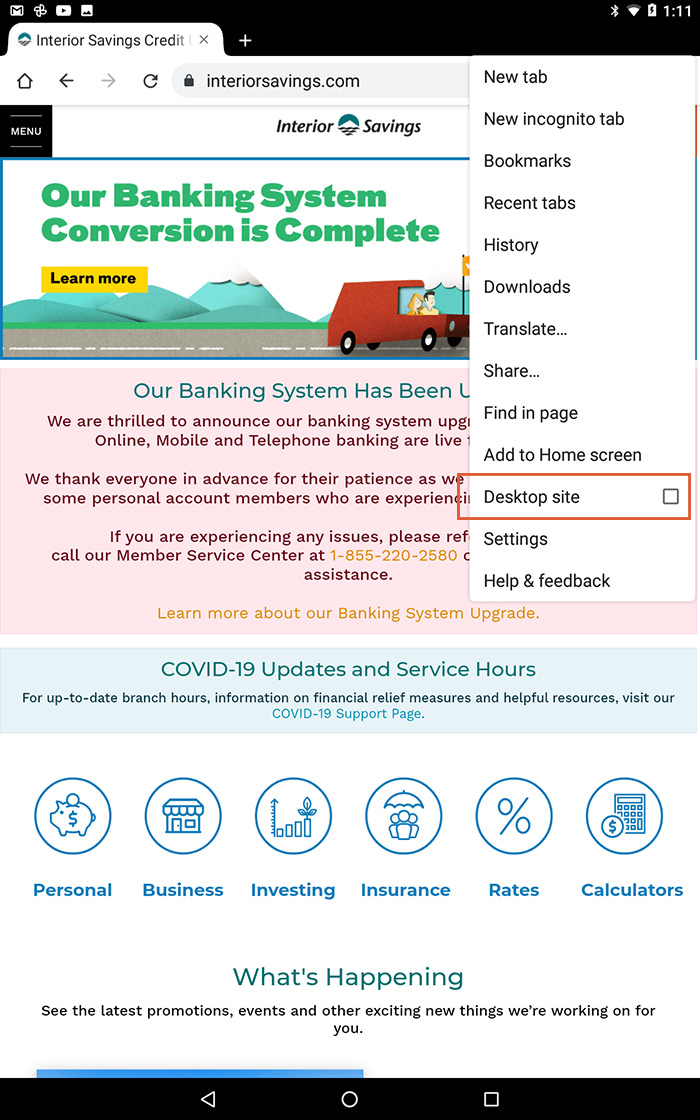

Is a laptop or desktop computer required to log into online banking after conversion. What if I only have a mobile phone or an iPad?

I understand my account number is changing. How will this look in online banking? How will I recognize my accounts?

I didn’t rename or nickname my accounts before conversion. Now it is difficult to identify my accounts. What can I do?

What other changes will I see in online banking?

Will links to my Collabria Credit Card, Credential Direct or Qtrade remain in place after the conversion?

Bill Payments, Pre-authorized Withdrawals and Direct Deposits

I didn’t change my payment date and a bill was scheduled to be paid during the conversion of September 18 to 21. What happens now?

My automatic payment for a car loan comes out on the 19th. Will the payment still go through or does it need to be rescheduled? Do I need to call the company and rearrange payment?

My payroll/CPP/Child Tax was supposed to be deposited on conversion weekend. Do I need to do something?

What information do I give to my employer so I can get my payroll set up to deposit automatically?

What information do I give to my utility company so I can get my utility bill set up for automatic payment?

What information do I give to my credit card company so I can pay my bill from my Interior Savings account as my account number has changed?

Interac® e-Transfers

Can I send an Interac e-Transfer during conversion weekend on September 18 to 21? What happens if I try?

I lost my Interac e-Transfer recipient list and security questions. How do I get them back?

I sent an Interac Request Money to someone during September 18 to 21. Is it still valid?

I need to pay someone during the conversion weekend via Interac e-Transfer and it won’t work. Is there another way to pay them?

What do I need to reset features in Interac e-Transfers?

Do Interac e-Transfers that did not Auto-deposit over the weekend need to be reset? Or will they deposit once the conversion is complete?

Small Business Online Banking

I can’t access my small business online banking account. What should I do?

What do I need to do to use Small Business Online Banking after the conversion?

I am unable to do an ATM deposit to my business account. What can I do?

Lines of Credit (LOC)

Is my Line of Credit (LOC) changing?

How will the LOC appear on my statement or in online banking?

What if I write a cheque and there are not enough funds in my chequing or savings account to cover the amount but I have a LOC that can be used?

What kind of payment do I have to make to my LOC?

How do I make a principal payment to my LOC?

Can I set up or use pre-authorized debits or credits on my LOC?

What if I have an Overdraft and a LOC? What will happen if I don’t have enough funds in my chequing account for a transaction?

What if I don’t have the funds in my chequing or savings account to cover the the monthly interest payment? Will this amount transfer from the LOC to cover this payment?

Account & Membership Related FAQ’s

Will my account member number change?

Will there be changes to Personal Banking Accounts?

Will there be changes to Business Banking Accounts?

Will my line of credit be impacted?

Interior Savings has discontinued passbook printing. What options are now available if I want an update on my banking information?

Transaction History

Where did my transaction history go? I need it to download it into my accounting software

Accounts

Does Interior Savings have my SIN on file? What if I’m a joint member?

Banking System FAQ’s

What is a banking system and why is ours changing?

Why is Interior Savings upgrading the banking system?

How will a new banking system benefit me?

Will there be additional costs to members from the upgrade?

Will the banking system upgrade eliminate jobs? Will customer service change?

The communications to date mention the new banking system will be better for Interior Savings and staff, how so?

How will Interior Savings be communicating information about the banking system upgrade?

How will I know if an email about the system upgrade is from Interior Savings?

Will customer service change as a result of the banking system upgrade?

Statements

Will I still receive my statement via my preferred method – paper or e-Statement?

Will I still receive a monthly statement for each product?

Will my statements still look the same?

Will I see my RRSP, TFSA or RRIF on my statement?

How do I access e-Statements from before the banking conversion?

How do I switch from paper statements to e-Statements?

Have Questions About the Upcoming Banking Conversion?

Don’t hesitate to get in touch. Our team is always happy to help.