Frequently Asked Questions

- ATM, Online, Mobile & Telephone Banking FAQ’s

- Bill Payments, Pre-authorized Withdrawals and Direct Deposits

- Interac® e-Transfers

- Small Business Online Banking

- Lines of Credit (LOC)

- Account & Membership Related FAQ’s

- Transaction History

- Accounts

- Banking System FAQ’s

- Statements

ATM, Online, Mobile & Telephone Banking FAQ’s

Will I be able to make bill payments at the ATM? What are my options for bill payments?

Bill payments at the ATM will not be an option after the banking system upgrade. The good news is there are still many convenient ways to pay your bills. These include:

- Online and mobile banking

- Teletouch banking

- Call our Member Service Centre

- By setting up bill payments to be paid automatically from your Interior Savings credit card

- By visiting a branch

Will Teletouch Banking function differently?

Yes, there will be some minor enhancements to Teletouch Banking with changes to menu options.

Will there be any changes to the Budget and Spending Tools within Online Banking?

The Budget and Spending tools did not carry over to our new banking system.

Our new banking system will offer us the opportunity to bring you more enhanced solutions down the road that will improve your experience and ability to manage your finances.

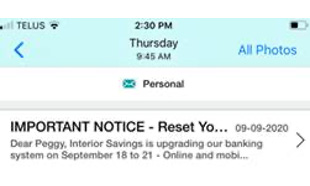

What does the message with the temporary password/PAC look like?

Before September 18, you should have received instructions for a temporary password in online banking and on your mobile app (if you have the app downloaded). Note – this message is only available until September 18. Please click on the following messages for the instructions:

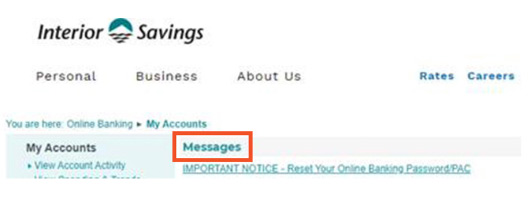

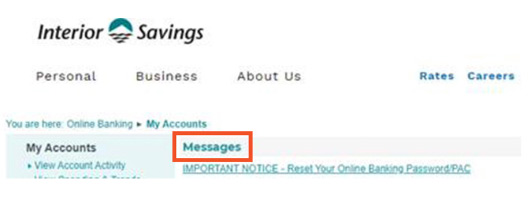

- In online banking:

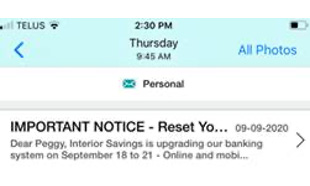

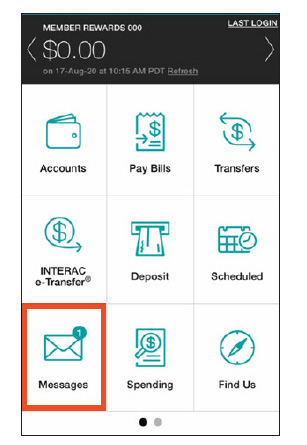

- In the mobile app:

Why didn’t I receive a temporary password to log into online banking after the conversion?

To receive the temporary password, members would need to have signed into online banking this past year and had their MemberCard card issued before August 5th.

My online banking password/PAC is not working. How do I set up a new PAC?

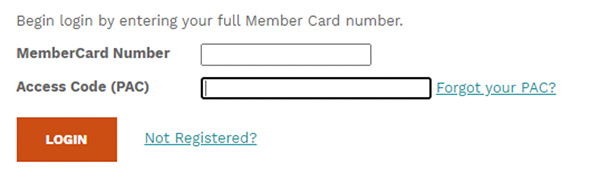

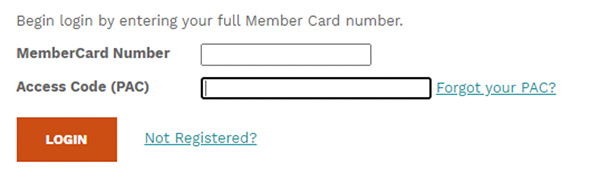

You can set up a new password/PAC by clicking on ‘Forgot your PAC?’ on the online banking login page (see below) to reset your password after September 21st.

You can also call our Member Service Centre for help at 1-855-220-2580 after September 21st.

How do I reset my password after the conversion?

Instructions for resetting your password can be found on our Banking Conversion Checklist and in the ‘how to’ video on resetting your password.

STEPS:

Please retrieve your temporary password for online and mobile banking before September 18. Instructions have been sent to you securely within online and mobile banking (screenshots below). The temporary password is needed to log in after the system upgrade is over on September 21.

Before September 18

a) Open and view your secure Message in either online banking or mobile banking:

- Mobile App:

- Desktop:

b) Read the Message for instructions and make note of your temporary password. Important: the temporary password will only be available until 6:00 pm on Friday, September 18.

After September 21

a) For that FIRST log in, you must use online banking on a desktop or laptop computer. This is a one time requirement.

b) Enter the temporary password that you noted from the secure Message under ‘Access Code (PAC)’.

c) Create a new secure password/PAC of your choosing

d) That’s it! If you are a mobile banking user, you will need to use the updated password next time you log into the mobile app.

Is a laptop or desktop computer required to log into online banking after conversion. What if I only have a mobile phone or an iPad?

You will need online banking, not the mobile app, to login for the first time after conversion. The reason for this is that, once signed in, you will need to reset your temporary password to a password of your choice – which is only available in online banking.

You can still login from a mobile device such as a phone or tablet, however, by using the link to our mobile-friendly site here https://online.interiorsavings.com/m/OnlineBanking/. You just can’t login the first time through the mobile app.

STEPS:

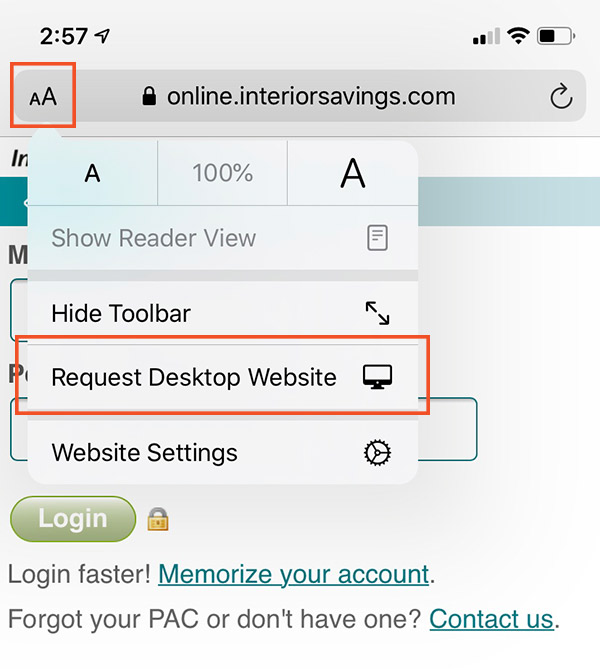

- Full Website can be accessed by pressing “Request Desktop Site” from the Menu once you are logged in.

iPhone

- To get to the full site from the mobile site on an iPhone, click on the “AA” to drop down the navigation menu and then click on “Request Desktop Website”.

- If you are using an older iOS and do not have the “AA”, click on the share icon and request desktop website.

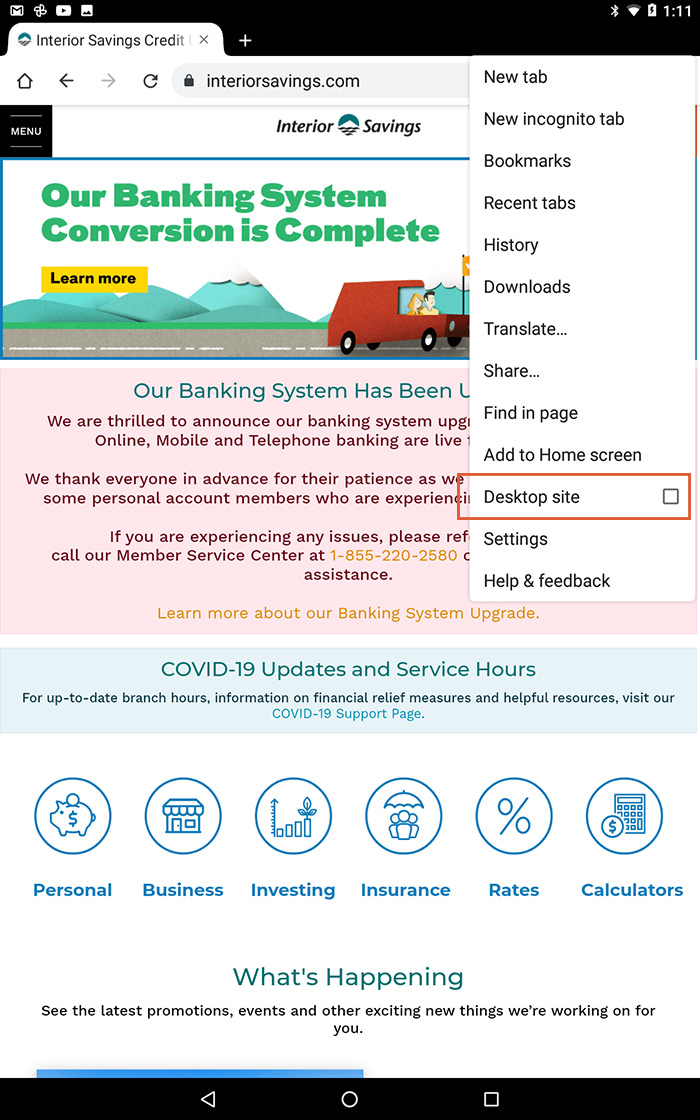

Android

- To get to the full site from an Android device, click on the “…” buttons to bring up the navigation menu then select “Desktop site”.

I understand my account number is changing. How will this look in online banking? How will I recognize my accounts?

Account numbers are changing with the banking conversion. Before September 18, we recommend that you nickname your accounts. To do this, go to ‘My Accounts’ and click ‘Rename an Account’ when logged in to online banking.

I didn’t rename or nickname my accounts before conversion. Now it is difficult to identify my accounts. What can I do?

To identity your accounts, we suggest looking at your recent transactions first. If you are still unable to identify your accounts, please visit an Interior Savings branch or call our Member Service Centre at 1-855-220-2580

What other changes will I see in online banking?

There are a number of smaller changes to be aware of in online banking:

- RRSP and TFSA products held by joint members will move and only be seen by joint members.

- A ‘Transfer’ to another account will now show as a ‘Withdrawal’. The recipient of the ‘Transfer’ will see the transaction as a ‘Deposit’.

- You will no longer be able to edit a Scheduled Transfer or a Scheduled Bill Payment. If necessary, you will need to delete the Scheduled Transfer or the Scheduled Bill Payment and then create a new one.

- There are more options for scheduling a Recurring Bill Payment or Transfer including Daily, Weekly, Bi-Weekly, Monthly, Quarterly, Semi-Annually, and Annually.

Will links to my Collabria Credit Card, Credential Direct or Qtrade remain in place after the conversion?

If you have set up links to your credit card, Credential Direct or Qtrade accounts, then you will have to set these up again after September 21.

Bill Payments, Pre-authorized Withdrawals and Direct Deposits

I didn’t change my payment date and a bill was scheduled to be paid during the conversion of September 18 to 21. What happens now?

The bill payment will be processed on Monday, September 21, and backdated to the correct payment date.

My automatic payment for a car loan comes out on the 19th. Will the payment still go through or does it need to be rescheduled? Do I need to call the company and rearrange payment?

Any pre-authorized, automatic payment occurring during the conversion weekend will be processed on Monday, September 21 and backdated to the correct payment date.

My payroll/CPP/Child Tax was supposed to be deposited on conversion weekend. Do I need to do something?

No, direct deposits occurring during conversion weekend will be processed. The deposit will show in your account on Monday, September 21. You will not need to update or change these after the conversion.

What information do I give to my employer so I can get my payroll set up to deposit automatically?

The branch can provide you with a Pre-Authorized Credit/Debit form to give to your employee. This form may also be printed directly from your Online Banking. In some cases, a void cheque may also be submitted to the employer.

What information do I give to my utility company so I can get my utility bill set up for automatic payment?

The branch can provide you with a Pre-Authorized Credit/Debit form to give to your utility company. This form may also be printed directly from your Online Banking. In some cases, a void cheque may also be submitted to the utility company.

What information do I give to my credit card company so I can pay my bill from my Interior Savings account as my account number has changed?

It is not necessary to update your account number with your credit card company. If you have auto-payments set up, these will continue with your new account number. We have linked your old account number to your new account number in the background.

If you wish to update your account number with the credit card company, the branch can provide you with a Pre-Authorized Credit/Debit form. This form may also be printed directly from your Online Banking.

Interac® e-Transfers

Can I send an Interac e-Transfer during conversion weekend on September 18 to 21? What happens if I try?

You won’t have access to online or mobile banking during the conversion on September 18 to 21.

I lost my Interac e-Transfer recipient list and security questions. How do I get them back?

We highly recommend taking a screenshot of your Interac e-Transfer recipients and their contact information before September 18.

After the conversion on September 21, members will need to input their Interac e-Transfer recipients and their contact information again. The nice part is it’s a good time to clean up your recipient list and their contact information.

I sent an Interac Request Money to someone during September 18 to 21. Is it still valid?

No, any outstanding Interac transactions will not work during September 18 to 21. They will need to be reset again after September 21.

I need to pay someone during the conversion weekend via Interac e-Transfer and it won’t work. Is there another way to pay them?

Other payment options during conversion weekend include cash or personal cheque.

What do I need to reset features in Interac e-Transfers?

Instructions for resetting Interac e-Transfer features, including your recipient list, can be found on our Banking Conversion Checklist and on the ‘how to’ video.

Do Interac e-Transfers that did not Auto-deposit over the weekend need to be reset? Or will they deposit once the conversion is complete?

Your Autodeposit settings in Interac e-Transfers will need to be reset after our banking conversion. If you were sent an e-Transfer during the September 18 to 21, you should receive an email encouraging you to accept it instead of the typical Autodeposit notification.

If you didn’t receive this email, please ask the sender to cancel and resend the e-Transfer.

Note: Don’t forget to check your junk mail. The email may have been filtered out as spam.

Small Business Online Banking

I can’t access my small business online banking account. What should I do?

Please phone the Member Service Centre at 1-855-220-2580 or visit a branch after September 21 to receive a temporary password you can use to access Small Business Online Banking for the first time after the banking conversion.

What do I need to do to use Small Business Online Banking after the conversion?

We have created an easy to follow checklist for members who use Small Business Online Banking. There is also a ‘how to’ video, if you prefer. We also encourage you to phone the Member Service Centre at 1-855-220-2580 or visit a branch with your questions.

STEPS:

- New password at first login after September 21: The first time you log in after the upgrade, you’ll need to use a temporary password. To receive this temporary password, please come in-branch or call the Member Service Centre at 1.855.220.2580 on or after September 21.

- Click and accept – During your first login, you may be prompted to click and accept using Small Business Online Banking before proceeding in order to continue.

- Interac® e-Transfers – There are a few items that will need to be reset here:

- Profile – a new profile will need to be created on the upgraded system.

- Recipient List – Your current list won’t transition during the upgrade. To make it easier to recreate, we recommend taking screenshots of recipient email addresses, mobile phone number and the security questions you use with them.

- AutoDeposit – Your settings for this feature will need to be reset after the upgrade

- Request Money – Any outstanding requests for money after conversion weekend will be lost. So please cancel them before September 17th, and re-send them after the upgrade.

- Two Signer Accounts – Any transactions like transfers between accounts or bill payments that are still pending after September 21 will need to be canceled and recreated.

- Delegates & Consolidated Accounts – Your information for these features won’t carry forward to the new system, so you’ll need to reset them after the upgrade.

I am unable to do an ATM deposit to my business account. What can I do?

ATMs will be working during conversion weekend. Transactions will be posted by September 21. If you have an issue, please contact our the Member Service Centre at 1-855-220-2580.

Lines of Credit (LOC)

Is my Line of Credit (LOC) changing?

Effective September 21, your LOC will now appear differently on your monthly statements and within online and mobile banking. Your LOC will still be linked to the same chequing or savings account as it always has been, however with a few small changes:

- If your line of credit is $5,000 or over, it will now appear in your statement as a separate product. For instance, if before, you had a chequing account with the LOC attached, you will now see two accounts: a chequing account and an LOC account.

- Withdrawing from funds from your LOC will be virtually the same. When you withdraw funds, they will come from your chequing or savings account. If your account balance reaches zero, then the excess funds will automatically be withdrawn from the LOC linked to that account. You may also transfer funds from your LOC into any of your other accounts. One difference you may see is more transactions on your statement (to show funds drawing from the LOC and depositing to the chequing or savings account).

- The main change you will see is around deposits. Previously, if you made a deposit to your chequing or savings account, that deposit was automatically applied to the balance of your LOC attached to that account. Because your LOC is now functioning as a separate lending product, you now have control over when and how you want to pay back the principal balance of your LOC. Going forward, to make a principle payment on your outstanding LOC balance, you will need to transfer money into your LOC account. You can do this transfer via online banking or contact us to assist you. If you would like to set up a recurring monthly payment to the principal balance of your LOC, we can set that up as a pre-authorized payment. Interest payments on your LOC will continue to be automatically be pulled from your chequing or savings account on the last day of the month.

How will the LOC appear on my statement or in online banking?

To help you identify these accounts:

- The name of your chequing account will include a number in the 100s (e.g. 101, 102). If it’s a savings account, it will include a number in the 200s.

- The name of your new LOC account or any lending will include a numbers in the 500s (e.g. 501, 502). When looking in online banking, this will likely appear toward the bottom of your list of accounts.

If you wish to rename these accounts to be more meaningful to you, you can create nicknames for each one. We can help you or you can do it through online banking – learn more.

What if I write a cheque and there are not enough funds in my chequing or savings account to cover the amount but I have a LOC that can be used?

If you have a LOC and you write a cheque that is more than what is in your chequing or savings account, then the system will automatically transfer the money needed from the LOC that is connected to your chequing or savings account.

What kind of payment do I have to make to my LOC?

Your LOC will continue to automatically transfer a monthly interest-only payment from your chequing or savings account to your LOC. If you wish to make additional payments, you can make payments via online banking, contact the Member Service Centre at 1-855-220-2580 or visit your branch for assistance.

How do I make a principal payment to my LOC?

As the LOC is its own product now, to make principal payments you must transfer funds directly to your LOC. This can be done through online banking, by contacting the Member Service Centre at 1-855-220-2580 or by visiting your branch.

Can I set up or use pre-authorized debits or credits on my LOC?

No. Pre-authorized debits and credits cannot be set up on a LOC. Instead, you will have to run any pre-authorized debits and credits through your chequing or savings account, and then you can transfer money to or from your LOC. If a pre-authorized debit goes through your chequing or savings account and there aren’t enough funds for it, the balance will be transferred from your LOC to your chequing or savings account.

What if I have an Overdraft and a LOC? What will happen if I don’t have enough funds in my chequing account for a transaction?

If you have both of these products and there is not enough money in your chequing or savings account to cover a transaction, then the remaining funds will always be taken from the Overdraft first. If the Overdraft cannot cover the full amount, then additional funds will transfer from the LOC to the chequing or savings account to cover the full amount.

What if I don’t have the funds in my chequing or savings account to cover the the monthly interest payment? Will this amount transfer from the LOC to cover this payment?

No. If the LOC monthly interest payment is due and there are not enough funds in the chequing or savings account, these funds will not transfer from the LOC. This means the LOC will become delinquent.

Account & Membership Related FAQ’s

Will my account member number change?

Yes, all members will be assigned a new member number as part of the banking system conversion. As a result of the upgrade we will shift the focus from you as a number to you as a member.

Following the banking system conversion, we will be organizing your member information in a different way. Moving to a person focused system will provide each member with a unique new member number and eliminate the multiple member numbers that some members have today. With this shift, members will see one consolidated view of all their banking and products. For our staff, we will have a better view which will also allow us to serve you better.

Although you will have a new member number randomly assigned to you, there won’t be any changes to your banking. Our background processes will be able to link your existing account numbers under the old banking system to a new member number in the new banking system. With this work being done securely in the background, you’ll be able to continue with your day to day banking activities you have set up. This means:

- No need to memorize or remember a new member number. When you visit a branch or call our Member Service Centre, our team of experts will be able to assist you with your banking – without the inconvenience of looking up a member number.

- Cheques: you can continue to use your existing cheques as they will continue to be valid.

- Preauthorized deposits and withdrawals: preauthorized transactions such as payments and direct deposits will carry over to the new system. This includes bill payments and payroll deposits which will continue unchanged.

- ATM and Debit Cards: all MemberCards will remain active and valid.

Will there be changes to Personal Banking Accounts?

There are a number of changes to our personal chequing and savings accounts.

Chequing Accounts:

- HeadStart Package (ages 0-17) – Going forward, our HeadStart members will be receiving our ‘Ultimate Package’ at no charge. You will see your account called this both in online banking and on statements. This change will mean you now receive unlimited transactions per month instead of 50 free transactions.

- MyChequing Package (ages 18-24) – Our MyChequing members will now be receiving our ‘Ultimate Package’ at no charge. You will see your account called this both in online banking and on statements. This change will not alter your package benefits. You will still receive unlimited transactions per month.

- Horizon Package (ages 60+) – Our Horizon members will now receive our ‘Ultimate Package’ at no charge. You will see your account called this both in online banking and on statements. This change will not alter your package benefits. You will still receive unlimited transactions per month, as well as 2 free US ATM withdrawals/month.

Savings Accounts:

- Property Tax Savings Account – This account has been converted into a new Plan24 Savings Account and your transaction history has been carried forward. Please note that this change only affects the Property Tax Savings Account. It does not change the Tax-Free Savings Account.

- TBill Savings Account – This account has been converted into a new Investment Savings Account (ISA) and your transaction history has been carried forward. The new ISA will give you:

- Increased savings interest

- Two free transfers a month. Any additional transactions or withdrawals will be $5 each

Will there be changes to Business Banking Accounts?

For business members, we will be introducing a new Business Flex Package in place of our Business Packs. This new account has six tiers and will automatically adjust to the correct tier each month based on the number of transactions done. This way you will only pay for what you use.

Will my line of credit be impacted?

If you have a line of credit, your line of credit and chequing account may now appear as separate accounts under Account Summary. You will see separate balances and details for each account.

Interior Savings has discontinued passbook printing. What options are now available if I want an update on my banking information?

While our passbook printers have been discontinued, there are still plenty of ways you can manage your money with us. This includes using our online banking tool, mobile app, Member Service Centre and over 3,600 ATMs across Canada. Take a look at our ways to bank page to learn more.

Transaction History

Where did my transaction history go? I need it to download it into my accounting software

Transaction history is being converted, and you will have access to it again on September 21st.

Accounts

Does Interior Savings have my SIN on file? What if I’m a joint member?

Majority of members have their SIN on file as this is a requirement for opening an account at a financial institution. If you are unsure, please contact the Member Service Centre or get in touch with your branch. IMPORTANT: Interior Savings will never send you an email or text requesting or asking for your SIN.

Banking System FAQ’s

What is a banking system and why is ours changing?

A banking system is the internal software we use to manage your daily transactions. Instead of simply updating our current software we are upgrading to an entirely different system with new and better features. Staff will find the new system easier to use and more efficient. Members will gain access to new and in-demand services while adding additional safeguards to already secure system.

Why is Interior Savings upgrading the banking system?

The purpose of the upgrade is to ensure our banking system leverages the latest technologies and accommodates current and future enhancements so we can continue to serve you better. Instead of simply updating our current program we’re upgrading to an entirely new system with better features

How will a new banking system benefit me?

With this new system, our staff will be equipped to serve you better. We’ll be working on a more advanced system that gives a more detailed profile on your finances; this way we’ll be able to better understand your personal financial needs.

The newer, more robust system will connect Interior Savings with the latest, cutting edge technology and allow our employees to focus their time on you and your financial needs. This will allow us to enhance the way we deliver banking services to you – our members.

Will there be additional costs to members from the upgrade?

No, there won’t be any cost to our members. We’re making this change to ensure we keep pace with technology and bring you the latest banking innovations.

Will the banking system upgrade eliminate jobs? Will customer service change?

Moving to our new banking system won’t result in any job cuts. It will simply streamline our staff’s work so they can spend more time helping you with your banking needs and less time on back-office processes.

The communications to date mention the new banking system will be better for Interior Savings and staff, how so?

The banking system upgrade will take place mainly behind the scenes, improving our processes and efficiency so we can serve you better. As a result, you won’t see many changes to how you bank with us. But we want to communicate this upgrade ahead of the conversion weekend to ensure you’re aware of what’s happening and how it may impact you.

There will be more information to come as “we move forward”, so please make sure to read our emails and check our support hub often for updates.

How will Interior Savings be communicating information about the banking system upgrade?

- Email: We will be emailing members frequently leading up to the conversion weekend to ensure our members are kept up to date and receive information about the upgrade. Please ensure we have your correct email and contact information so you receive updates. You can update your contact information within Online Banking, by visiting a branch or by calling our Member Service Centre at 1-855-220-2580.

- Local Matters blogs: We will be publishing monthly articles about the system upgrade and changes coming. Visit our blog and subscribe to our monthly e-newsletter if you don’t currently receive it.

- Online Banking: We will send secure messages that will let you know of specific impacts you should be aware of to help transition to the new system.

- Website: In addition to sharing highlights of the system upgrade on www.interiorsavings.com we have also created a support hub that will have more details about the system upgrade.

- In branch materials: Branches will display announcements as well as provide printed copies of resources and printouts to help members during the transition.

E-Statement Inserts: We will create e-statement inserts as or if needed.

How will I know if an email about the system upgrade is from Interior Savings?

Interior Savings will never send you an email or message asking you to verify any personal information including account information. Other items to be aware of:

- Stay up to date: Keep your computer’s Operating System and Security Software up to date.

- Be cautious: If you’re not sure about a website or email, close it or delete it.

- Use Alerts: Set up online or mobile security alerts on your account. Examples include alerts to notify you when your account has been accessed, new payment vendors have been added or a request has been made to reset your password/access code.

- Report it immediately: If you suspect you’ve fallen victim to a fraud, contact Interior Savings or local authorities to report it.

- Is your contact information current: Things change – including phone numbers, email and addresses. One additional way you can help to prevent fraud is by ensuring we have your current contact information on file. The next time you’re in your local branch, please confirm that the phone numbers, email and address we have on file for you are correct. You can also update your contact information within Online Banking or by calling our Member Service Centre at 1-855-220-2580.

Will customer service change as a result of the banking system upgrade?

Customer service and our members’ financial health has always been of top importance to Interior Savings. The new banking system will not replace the face-to-face customer service you trust and count on. Moving to our new banking system will simply streamline our staff’s work so they can spend more time helping you with your banking needs and less time on back-office processes.

Statements

Will I still receive my statement via my preferred method – paper or e-Statement?

Starting with September month-end, statements will be created based on account ownership to ensure information is kept private. This means:

- Main member on an account – Prior to conversion, members who were the main or first named person on an account will continue to receive statements via their preferred method – paper or E-Statement.

- Second named member on an account – Prior to conversion, members who were the joint or second named person on an account will only receive an e-Statement going forward.

Will I still receive a monthly statement for each product?

Paper statements and e-Statements will continue to be sent at the end of each month. However, you’ll only receive one statement that covers all the products you hold, and businesses will receive a separate business statement.

Note that due to the banking system conversion, members will receive two statements for this September only:

- Sept 1 to Sept 18 for activity prior to the conversion

- Sept 19 to Sept 30 for activity post-conversion

Will my statements still look the same?

Your statement will have a slightly different look and layout. To learn more, visit our Statements Support Hub page.

Will I see my RRSP, TFSA or RRIF on my statement?

Moving forward, members who own and therefore whose name is on an RRSP, TFSA or RRIF contract will be the only members who will see these products on their statement.

How do I access e-Statements from before the banking conversion?

There are some changes to how you can access statements from before September 2020:

- Main member on an account: Prior to conversion, members who were the main or first named person on a membership will be able to view prior monthly e-Statements in online banking by clicking ‘My Accounts’, then ‘View e-Statements’.

- Second named member on an account: e-Statements from previous months are not available to members who are not the main member on an account. However, banking history is available in online and mobile banking for all account signers.

If you require a copy of an old paper statement, please call the Member Service Centre at 1-855-220-2580 or visit your local branch.

How do I switch from paper statements to e-Statements?

If you use online banking, you have the option to receive statements electronically (called e-Statements) instead of paper statements by mail. These e-Statements can be downloaded, kept as an electronic copy or printed as needed at home.

To sign up for e-Statements, please visit your branch or call the Member Service Centre at

1-855-220-2580.

Have Questions About the Upcoming Banking Conversion?

Don’t hesitate to get in touch. Our team is always happy to help.